Dianchi Daily Insights

Stay updated with the latest news and trends in technology and lifestyle.

Stay updated with the latest news and trends in technology and lifestyle.

Discover how Bitcoin is changing the financial landscape and why joining this digital gold rush is an opportunity you can't miss!

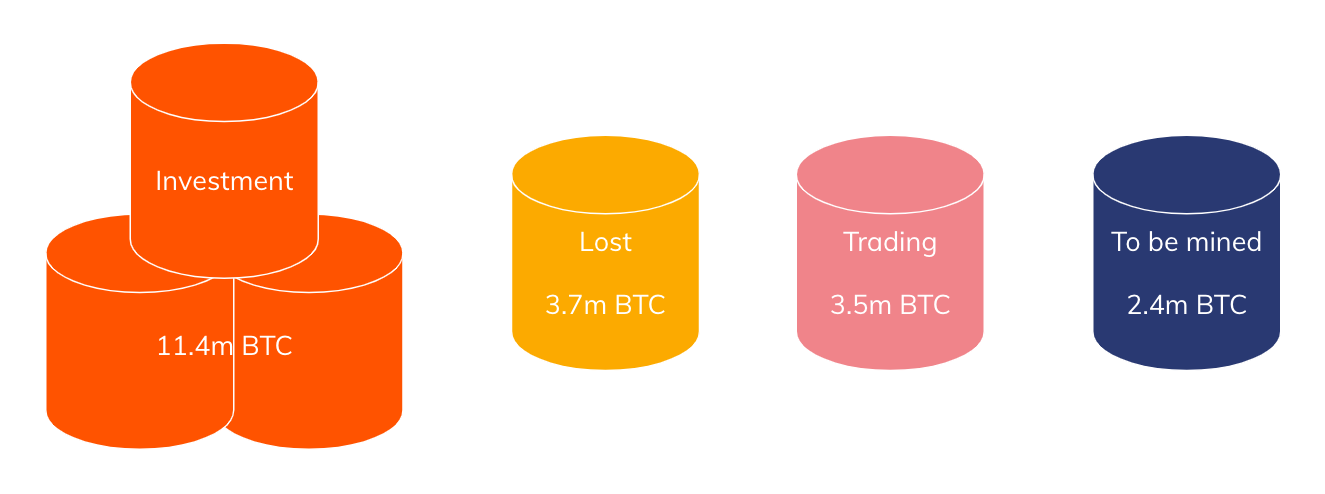

Bitcoin is a decentralized digital currency created in 2009 by an unknown person or group of people using the name Satoshi Nakamoto. Unlike traditional currencies issued by governments, Bitcoin operates on a peer-to-peer network that allows users to send and receive payments without relying on intermediaries like banks. Powered by blockchain technology, it ensures transparency, security, and immutability of transactions. As a pioneer in the cryptocurrency space, Bitcoin has gained significant traction and is often referred to as digital gold due to its similarities with gold in terms of scarcity and value storage.

Bitcoin is considered digital gold for several reasons:

The investment potential of Bitcoin has captured the attention of both seasoned investors and newcomers alike. As the world of digital currency matures, many are left wondering: Is it too late to join the gold rush? With Bitcoin’s price experiencing significant fluctuations, it's essential to consider the underlying factors that contribute to its valuation. According to Investopedia, Bitcoin’s limited supply and growing demand enhance its desirability as an alternative asset class, similar to precious metals like gold.

Moreover, Bitcoin has proven to be a hedge against inflation and currency devaluation, which makes it attractive for long-term investors. A 2023 report by Fidelity indicates that institutional adoption is on the rise, further legitimizing Bitcoin as a mainstream investment. As you ponder whether it's too late to invest, keep in mind that Forbes suggests that with proper research and a well-structured investment strategy, one can still reap significant benefits in this evolving financial landscape. As with any investment, understanding the risks and opportunities is key to navigating this digital frontier.

Bitcoin, often heralded as the pioneer of cryptocurrencies, is fundamentally altering the landscape of money and finance. Its decentralized nature eliminates the need for traditional intermediaries, allowing for peer-to-peer transactions that enhance efficiency and reduce costs. As more businesses and consumers adopt Bitcoin as a viable payment method, we are witnessing the emergence of a new financial paradigm that challenges conventional banking systems. This shift is not merely a trend but a significant movement towards a future where financial autonomy is paramount.

The implications of Bitcoin's rise extend beyond transactions; they foster a revolutionary approach to investment and savings. With tools like Bitcoin wallets and decentralized finance (DeFi) platforms, individuals can now participate in an ecosystem that prioritizes transparency and security. Moreover, as Bitcoin adoption continues to widen, the potential for economic empowerment grows, particularly in underbanked regions, where traditional banking services are scarce.