Dianchi Daily Insights

Stay updated with the latest news and trends in technology and lifestyle.

The Digital Wallet Integration Revolution: Are You In or Out?

Discover how digital wallet integration is transforming the way we pay. Don’t miss out – find out if you're in or out of the revolution!

The Future of Payments: How Digital Wallet Integration is Changing the Game

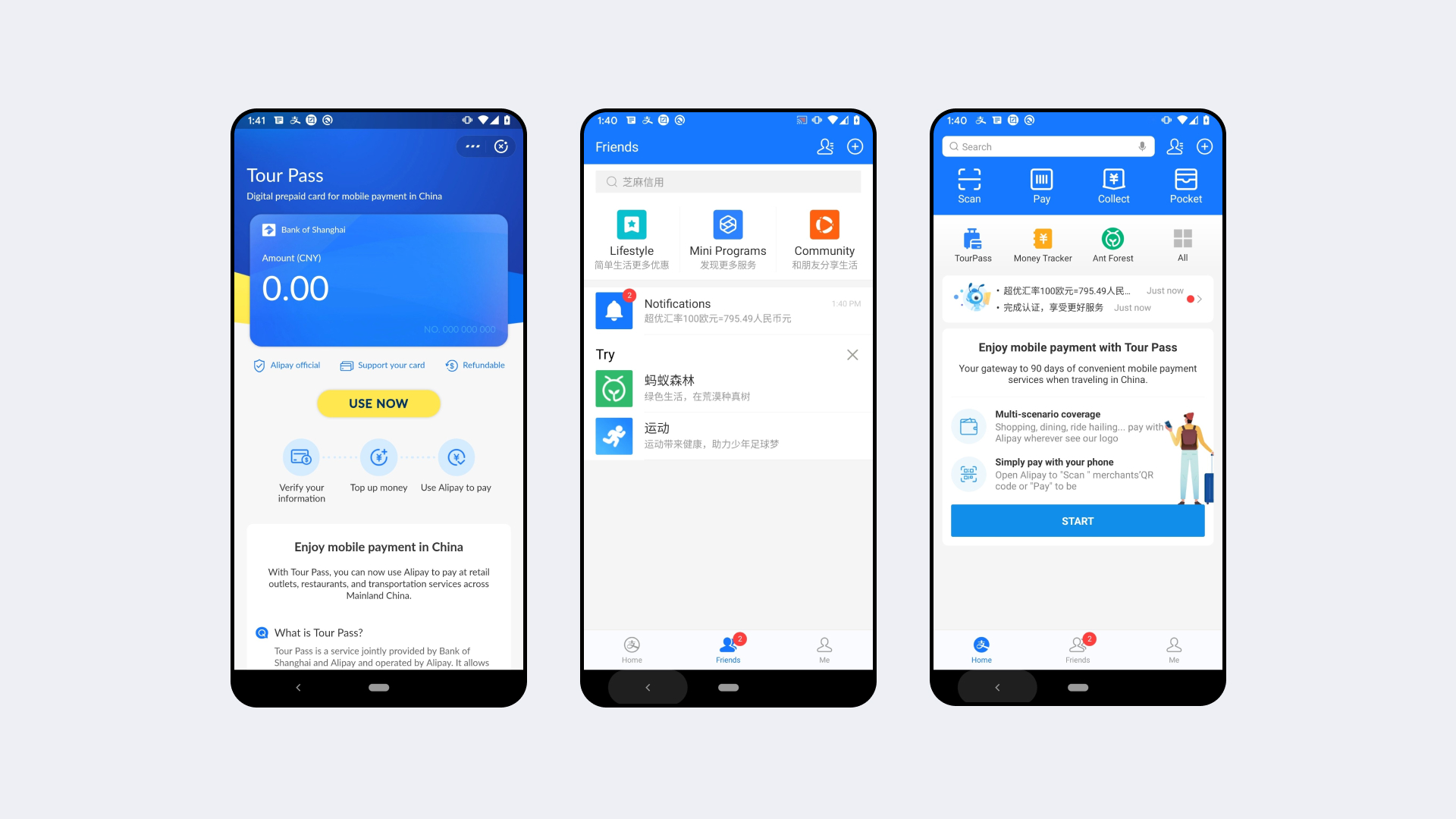

The landscape of financial transactions is undergoing a transformative shift with the rise of digital wallets. As consumers increasingly embrace the convenience and security that comes with using digital wallet integration, businesses are compelled to adapt. This technology allows users to make payments through smartphones and other devices, streamlining the purchasing process and enhancing user experience. With companies like Apple Pay, Google Wallet, and Samsung Pay leading the charge, the adoption rates are climbing rapidly. According to industry reports, the digital wallet market is expected to surpass $7 trillion by 2027, highlighting its significance in the financial ecosystem.

Moreover, the integration of digital wallets is not only changing how we pay but also how businesses operate. Companies can leverage this technology to gather invaluable customer data, tailor offerings, and improve customer engagement. With features such as instant payment confirmation and loyalty rewards, digital wallets encourage repeat business and foster customer loyalty. As we look ahead, it's evident that embracing this payment method is not just a trend but a necessity for businesses aiming to thrive in an increasingly competitive market.

Counter-Strike is a popular tactical first-person shooter game that emphasizes teamwork and strategy. Players engage in intense matches as either terrorists or counter-terrorists, completing objectives such as planting or defusing bombs. Many gamers enjoy enhancing their experience through various platforms, and you can find exciting offers like the betpanda promo code to boost their gameplay.

Top Benefits of Adopting Digital Wallets for Your Business Today

In today's fast-paced digital economy, adopting digital wallets offers businesses a myriad of benefits that enhance both customer experience and operational efficiency. Firstly, digital wallets streamline the payment process, allowing for quick, secure transactions that can significantly reduce checkout times. This seamless experience not only pleases customers but also encourages repeat business, as shoppers are more likely to return to a brand that provides a hassle-free payment method. Furthermore, digital wallets can help businesses reduce costs associated with processing traditional transactions, such as credit card fees and handling cash.

Another compelling reason to embrace digital wallets is the valuable data insights they provide. Businesses can track purchasing patterns and customer behavior through digital wallet transactions, enabling them to tailor marketing strategies and personalize customer engagement. This analytic capability creates opportunities for targeted promotions and improving product offerings. Additionally, with an increasing number of consumers preferring cashless transactions, adopting digital wallets not only meets this growing demand but also positions businesses as modern and innovative in a competitive marketplace.

Are You Prepared for the Digital Wallet Revolution? Key Questions to Consider

The rise of digital wallets is reshaping the way we handle transactions, but are you prepared for the digital wallet revolution? As more consumers embrace cashless payments, it’s crucial for businesses and individuals alike to understand the implications of this shift. Start by asking yourself whether your current payment systems are equipped to accept digital wallets like Apple Pay, Google Wallet, and others. Assessing your existing infrastructure can help ensure that you’re not left behind in this rapidly evolving landscape.

In addition to payment acceptance, consider the security features of digital wallets. Are you aware of how these platforms protect user data against fraud and breaches? It’s essential to evaluate your own security measures and stay updated on best practices to safeguard sensitive information. Furthermore, think about the user experience: are your customers ready to make the transition? Conducting surveys or gathering feedback can provide valuable insights into their preferences and readiness for a cashless future.